On August 26, 2020, the US Securities and Exchange Commission (“the SEC”) announced its first significant set of investor disclosure requirement revisions in the past 30 years. These revisions require that investor communications such as prospectuses and annual reports include more detailed descriptions of human capital management risks and impacts to the organization. They are mandatory for any organization that is publicly traded on any US stock exchange (whether based or headquartered in the USA or not) and that asserts that human capital is “material” to their business.

For this article, WSR Co-Managing Editor Bob Greene interviewed Editorial Board member Jeff Higgins, Founder and CEO of the Human Capital Management Institute, to learn just what these changes mean for HR, organizations generally, and particularly for the HCM professionals making up our readership.

Background

The Securities and Exchange Commission’s Regulation S-K specifies disclosure requirements with which all publicly traded companies in the US must comply. These are intended to ensure that potential investors have the information they need to realistically evaluate the risks associated with investing in a particular security. And given that human capital, as a topic, has never appeared significantly in disclosure regulations before, it’s “kind of a big deal” – for both HR and HR technology professionals.

This action by the SEC should be seen as occurring not on a standalone basis, but rather in the context of other, similar actions being taken by governing boards to promote “good deeds” among corporate boards – good deeds which often depend on HR’s hard work. Just one week before the SEC took this action, the Business Roundtable issued a formal statement “redefining the purpose of a corporation” – moving away from a virtually solitary focus on building shareholder value, and including the following statement:

“We commit to….Investing in our employees. This starts with compensating them fairly and providing important benefits. It also includes supporting them through training and education that help develop new skills for a rapidly changing world. We foster diversity and inclusion, dignity and respect.”

While such a statement might be expected from the head of a labor union or employee collective, it was rather extraordinary coming, as it did, from an NGO composed of CEOs and owners of more than 180 of the world’s largest corporations. Indeed, on its website, the Business Roundtable proudly proclaims its members are responsible for generating almost $300 billion per year in shareholder dividends, so this change of focus by them was also “kind of a big deal.”

In December, 2020, a few months after the SEC revised Regulation S-K to include these new human capital disclosure requirements, the NASDAQ stock exchange filed with the SEC to adopt a new requirement that all 3,000 of its listed companies increase and maintain the diversity on their boards of directors by ensuring at least one female director and one underrepresented minority (and/or LGBTQ+) director, and to make public disclosures around their Board diversity statistics.

It should be noted that, months earlier, corporate underwriting titan Goldman Sachs had already committed to refuse to take public any organization that lacked at least one female and one minority director. At this writing, the proposed NASDAQ rule is still in the SEC public comment period, but is expected to be approved and adopted.

When is a Choice Not Really a Choice?

WSR Editorial Board member Jeff Higgins comments that when it comes to the new Regulation S-K human capital management disclosures, employers theoretically have two choices, but should be very careful in making that choice. To avoid being subject to the new disclosure rules, an employer can make a rather extraordinary disclaimer – that human capital is not material to their overall business performance. Such a disclaimer might be more believable for, say, a manufacturer with highly automated processes than for, say, a consulting firm whose product is their employees’ expertise. Taking such action may enable a corporation to avoid any new human capital disclosure reporting – even the total number of people they employ!

But for any business disclaiming the importance of human capital in their operations, they should be prepared for the “fallout.” CEOs and other corporate spokespeople would have to immediately refrain from messaging around “our people are our most valuable asset,” as well as statements focusing on diversity, competitive compensation and benefits, talent development, etc. Existing risk disclosure language relating to human capital in federal filings (e.g., 10K, 10Q) would likely have to be removed. Most importantly, these companies should prepare for major pushback – perhaps even precipitous divestment – from institutional investors, and possibly class action or shareholder derivative suits. The bottom line is that a claim by a publicly traded company that their human capital is not material to their business performance stretches credulity in most cases.

The Right Decision

There’s no doubt that the vast majority of impacted organizations will choose to comply with the new SEC Regulation S-K revisions, rather than “fighting city hall.” Unfortunately, the language of the revision doesn’t give them a lot of guidance on how to do so. Specifically, the revision amends the applicable rule (101(c)) by adding the following words: “…including, as a disclosure topic, a description of the registrant’s human capital resources to the extent such disclosures would be material to an understanding of the registrant’s business.” Ironically, that very lack of specificity in the details of newly required human capital disclosures offers HR technology professionals an unprecedented opportunity to impact their organizations and pave a more permanent path for their CHROs to the executive roundtable. “There’s a real possibility of a new HR reporting Renaissance,” according to Higgins.

So Where to Start?

The fact that the SEC has not provided specific metrics or clarity on exactly what to disclose in its new human capital reporting disclosure requirements does not leave organizations without resources or a place to start when putting together their reporting plans. In fact, in 2018, the International Organization for Standards (the ISO) published one of the standards sets, for which they are so well-known, this time specific to HR reporting, ISO 30414. By way of background, ISO is a non-profit NGO that assembles sets of standards on given subjects collected from around the world, and best known for issuing more than 23,000 such sets of standards, like ISO 9000 (quality management), ISO 27000 (information security management), and ISO 14000 (environmental management) standards. A full copy of the ISO 30414:2018 HR reporting standards is available for purchase, at the ISO website.

ISO 30414 makes a great start for HCM professionals by identifying a series of “core human capital reporting areas:”

- compliance and ethics;

- costs;

- diversity;

- leadership;

- organizational culture;

- organizational health, safety and well-being;

- productivity;

- recruitment, mobility and turnover;

- skills and capabilities;

- succession planning;

- workforce availability

Of course, while this topical menu from ISO 30414 offers organizations planning their new disclosure reporting a wide range of options, it is reasonable to expect that each company will make decisions most appropriate to their situation. For example, in the spirit of risk disclosures, an organization having long-term difficulty filling key positions to a point that could impact production might decide to publish “Days to Fill Open Positions” reporting, while another organization recently entering into a hiring consent decree with the OFCCP might decide to publish a “Progress Toward Goals” report.

Regardless of an organization’s specific situation, there are a number of topics that, because of their current topicality, will be expected by most investor audiences to be included in the overall disclosure process. These include:

- talent measurement/skills and competencies

- rate of internal promotion vs. external hires, particularly for management positions

- workforce productivity (and validation of its measurement process)

- succession planning and bench strength

- environmental, social and governance (“ESG”) measures

Finally, organizations with significant operations in the United States must factor in to these new disclosure requirements the overall effect of a fundamental changeover in government party control and the impact that this change might have on HR policy and operations. Consider:

- the impact of a possible increase to the federal minimum wage, whether to $15.00 per hour or to some level lower than this,

- the potential return of mandated gender pay equity (EEO-1 Component 2) reporting, which was required in 2019 but suspended in 2020,

- the possibility of changes to overtime regulations that could impact decisions around the ratio of direct hire vs. contingent or interim workers,

- potential new paid family and medical leave mandates at the federal level, and

- possible new tax penalties for offshoring, and/or incentives for re-onshoring workers.

While all of these initiatives have been emphasized as legislative priorities for the new Administration, given the breakdown of party membership and control, none should be considered “a sure thing” at this writing.

Ensuring an Organization is “Reporting-Ready”

Deciding on what specific issues will be included in “material” human capital reporting disclosures is important, but only the beginning of the work HCM professionals must do to comply with the new rules. From there, the information must be gathered through our systemic reporting channels.

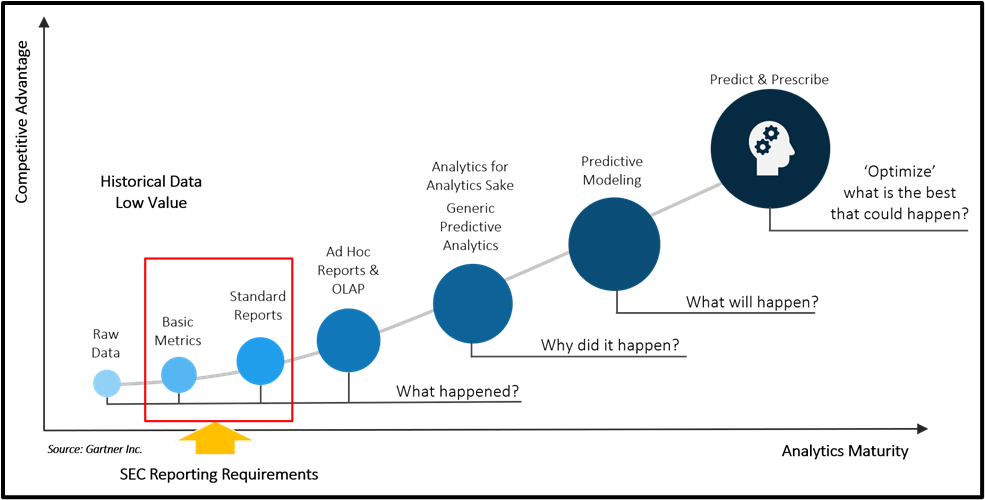

Gartner offers us a handy “reporting maturity model,” and despite the rather nebulous initial roll-out of the new SEC disclosure requirement, it is easy to discern that these disclosures are able to be satisfied at the simpler end of that model. (See Fig. 1.) For example, there is nothing in the new requirements that obligate organizations to explain why a particular risky situation arose, predict how it will progress from its current state or even propose corrective action. Of course, responsible corporate governance involves much more than simply pointing out risks; the steps being taken to address them are also an essential part of the disclosure as well. But those solutions and future plans are generally for an executive team or board of directors to establish, and communicate by narrative. The bottom line is that those teams look to the CHRO, and in turn the CHRO looks to HR technology professionals, to provide clean, current, reliable data on which to make the risk disclosures and make their decisions about remedial actions.

Back to Basics: An Honest Self-Assessment

At this critical juncture when the SEC has handed HCM professionals a “golden opportunity” to provide meaningful and essential data to the executive team, organizations need to exercise great care to avoid reporting mistakes of the past. These mistakes of the past include:

– Misleading data. This can include something as simple as a mistake in a spreadsheet or reporting formula, to more complex errors, like failing to statistically validate a data anomaly which, due to statistical insignificance, should never be reported at all. Some executive team members may not notice this, but many CFOs or CIOs would do so.

– Conflicting data from multiple systems. Companies large enough to be subject to these new disclosure requirements are also more likely than others to have multiple solutions in place for various aspects of human capital management – from HR to Payroll to Talent Management applications. Wherever the same data elements exist in multiple, disparate systems, integrations and interfaces must always be subject to continuous monitoring for “breakage” – from something as simple as reference table values updating in one system and not another, to actual conflicting data values in employee records. Too often, it only takes one such situation to cast doubt on the credibility of HCM reporting efforts for months or years to come.

– Stale data from data marts/warehouses. Similarly, when multiple systems are in use, many organizations will resolve conflicting data issues, or overcome reporting limitations, by establishing and maintaining a data mart or data warehouse. The ideal such design involves web services-based updates from owner systems to the data warehouse directly. Unfortunately, this approach is rare. Usually, updates to data warehouses may occur every few hours, nightly, or even less frequently than that. In these cases, it is imperative that disclosure of the update cycle (i.e., the “freshness” of the data being reported) be included with the reports being generated.

– Relying on external definitions and standards. Reporting terms like “turnover” and even HR terms like a status of “furlough” or “layoff” have no standard definitions across organizations, if not government regulated. This has been driven home by the pandemic and the reporting demands it has placed on employers. While ISO 30414 attempts to assign standard definition to certain key concepts, employers are not required to adopt them, and those definitions may not fit their businesses. If, for example, investors might assume that the term “furlough” implies a legal or union contract-based right to return to work where no such obligation exists, should disclosure reporting include reference to it?

– Failing to relate to both the “left brains” and “right brains” at the table. The theory of personality assessment and its impact on work groups assumes that every person is either “left-brained” or “right-brained” to some degree, and that appealing to these individuals will be easier and more successful if information is presented in their preferred form. Very simply stated, left-brained individuals tend to be more scientific, more data-oriented, focused on facts and details, and prefer nonfiction. Right-brained individuals tend to be more emotional, utilize imagination more frequently, focused on art and creativity, and prefer fiction. Most personality test products (e.g., Myers Briggs Type Indicator®, Working Styles Assessment™, etc.) account for similar dichotomies in their categorizations as well.

In presenting data to an executive team (and from there as part of a financial disclosure document), therefore, HCM professionals have to navigate through these differences. Should I present the table of detailed data as a spreadsheet? Or as a chart or graph? The best answer, of course, is “both,” and workforce analytics packages with good “drill-down” capabilities are able to offer both.

– Catching key stakeholders “by surprise.” Shareholders, who will be reading these new HCM disclosures, don’t like surprises – particularly negative ones – and neither do executive teams or boards of directors. The process of exposing and socializing negative workforce trends should therefore be subject to close monitoring. For example, a key productivity indicator that declines five percent per month for three months or more on a straight-line basis, is better exposed and highlighted monthly, rather than what might be considered a “precipitous” drop of 15 percent in a quarter. Fortunately, many HCM reporting and workforce analytic tools on the market today are capable of using “alerts” and push technology to bring these trends to key stakeholders’ attention when a particular pre-set “pain” threshold is reached.

Conclusion

Due to the recent revisions of Regulation S-K, new HCM disclosures are now required by the SEC for any organization publicly traded on any US securities exchange, and which deems human capital material to their operations. While the new regulations are a bit lacking in specifics, Jeff Higgins, Founder and CEO of the Human Capital Management Institute, points out that there are resources available for organizations to draw from in tackling this effort, and that it presents a significant opportunity for HR technology professionals to add to their value in supplying CHROs and their executive teams with much-needed data.

Fig. 1

Endnotes

https://www.sec.gov/news/press-release/2020-192

https://www.businessroundtable.org/business-roundtable-redefines-the-purpose-of-a-corporation-to-promote-an-economy-that-serves-all-americans

https://www.nasdaq.com/press-release/nasdaq-to-advance-diversity-through-new-proposed-listing-requirements-2020-12-01

https://www.iso.org/standard/69338.html