For Benefits directors at employers offering calendar-year-based health plans to their employees, summer is never quite the relaxing vacation season it is for some of their employees. It’s plan renewal season, and if costs increase dramatically year over year, those employers have just a few short months to decide on changes—sometimes sweeping changes—to those plans to be ready for Open Enrollment in late October or November.

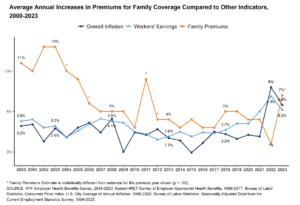

2024 is shaping up to be one of those years. Surveys conducted by the major benefits consulting firms earlier this year predicted the highest increases in employer healthcare costs, year over year, in more than 10 years. In the U.S., HR consulting firm Willis Towers Watson (WTW), earlier this year, predicted year-on-year medical benefit cost increases of 8.9 percent, while Buck Consultants, in a similar survey, predicted cost increases for 2024 of between 6.8 and 7.3 percent. Both of these predictions are significantly higher than the same numbers in 2023. Not only are these increase estimates some of the highest employers have seen in the last 10 years, but they are predicted in a context of general inflation, employee wage inflation, and increases in employee contribution rates for family coverage that, to put it bluntly, puts more and more employers into “sticker shock” territory going into 2025. (See Fig. 1., graph from Kaiser Family Foundation, kff.org.)

Figure 1.

Figure 1.

Given these realities, many employers will find themselves in a bind going into renewal talks with their insurance providers this year. Facing budget-busting cost increases, employers will be under unprecedented pressure to make the changes needed to keep their plans attractive to employees. This is particularly challenging in the current employment market, in which, for more than two years, we’ve seen unemployment rates under 4.4 percent and almost two available jobs for every unemployed person in America. (See “New Hire No-Shows and the Failure of First-Generation Onboarding[6]”, Workforce Solutions Review, Q1,2024.) Indeed, in a recent survey by Economist Impact, an astounding 70 percent of employees said they would be willing to change jobs for better benefits![i]

What’s an Employer to Do?

In the face of these multiple challenges, many employers will choose from multiple potential actions as they design their 2025 benefits offerings, focusing on healthcare cost control. Some of these actions ranked (arguably) from least “disruptive” from the employees’ perspective to most are:

- Moving from passive to active enrollment

- Introduction of voluntary wellness screenings

- Introduction of mandatory wellness screenings (e.g., health risk[7] assessments, biometric screenings)

- Imposition of increased coverage restrictions (prior authorization[4], step therapy, etc.) and/or formulary changes to prescription coverage

- Restrictive changes to healthcare networks

- Changes to any one of out-of-pocket maximums, deductibles, copays, and/or coinsurances

- Changes to multiples (or all) of the factors described above

- Increases to employee contributions for various plans/options

- Introduction of consumer-directed health plan(s) (e.g., FSA, HDHP, HSAs) as an employee choice

- Introduction of consumer-directed health plans as a forced change across the employee population (i.e., while eliminating “traditional” plans like PPO, HMOs, substituting HDHPs as the only available option).

An Age-Old Problem: Offering vs. Adoption

The famous tagline from Kevin Costner’s movie Field of Dreams was, “If you build it, they will come.” Unfortunately, for healthcare benefits design professionals, the corollary, “If you offer it, they will opt-in,” is not necessarily true. The real determinant of health plan re-design success is not how much the revised or new plan offerings save the organization but rather how well they are adopted by the eligible workforce. This is particularly true of first-year adoption of new consumer-driven health plans, like HSA-based plans.

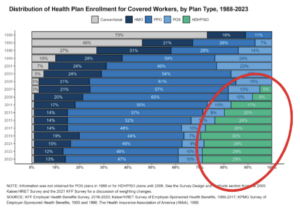

To put this adoption in perspective, examining overall enrollment data[8] over the past quarter century is useful. As seen in research by the Kaiser Family Foundation (kff.org; see Fig. 2), since their introduction around 2007, enrollment in HSAs has risen from about 5 percent to a stubborn ceiling of 28-30 percent over the last six years. Figure 2. Source: The Henry J Kaiser Family Foundation and The Health Research & Educational Trust, Employer Health Benefits, 2023 Annual Survey. (Note: red circle highlight added by author.) Can be accessed here: https://www.kff.org/slideshow/2023-employer-health-benefits-chart-pack/

Figure 2. Source: The Henry J Kaiser Family Foundation and The Health Research & Educational Trust, Employer Health Benefits, 2023 Annual Survey. (Note: red circle highlight added by author.) Can be accessed here: https://www.kff.org/slideshow/2023-employer-health-benefits-chart-pack/

Benefits experts believe that there are two main reasons for the failure of cost-saving insurance alternatives to catch on with employees: (a.) a tendency of employees, as consumers, to avoid the unknown and enroll only in plans with which they have experience – in other words, just like consumers generally, during enrollment, employees “don’t buy what they don’t understand,” and (b.) some really bad “marketing” on the part of HR and benefits professionals.

This “bad marketing” is not a new problem. Consumer-driven health plans (“CDHPs”) have existed for over two decades. Yet, when they first debuted, somehow they were named “High Deductible Health Plans” (“HDHPs,”) apparently under the misimpression that high deductibles were a selling point.[ii] (Why would anyone name a new product after its worst, most feared feature? After all, we call the main cabin on commercial flights “economy class,” not “super-cramped claustrophobic class.”)

Indeed, with the combination of poor naming, complex rules regarding the kinds of common services that may NOT be subject to that high deductible (e.g., preventive services, immunizations, well-baby care, etc.), and the still common practice of mailing or e-mailing a small mountain of often dull and dry pdf documents describing these plans, it is small wonder that employers on average fail to gain acceptance of them by more than 29 percent of enrollees – and in their first year of introduction, often much lower than that.

Furthermore, when employers take the traditional approach to benefits communications and enrollment materials, many employees spend less time on enrollment than their employers might hope that they do. A 2023 Greenwald Research survey found that 68 percent of health plan enrollees spend less than one hour educating themselves and choosing plans during open enrollment.[iii]

Additionally, employers’ focus on workforce wellness has been increasing for years – partly because an estimated 60 percent of all employers are self-insured for their health plans, making a more direct connection between employee health claims and corporate operating expenses. It is a proven fact that the illnesses resulting from employee mismanagement of chronic health conditions like diabetes, hypertension, asthma, and obesity (to name a few) cost employers far more in health claims and time off from work than those employer plan sponsors would pay for proper preventative care. Multiple recent surveys, including those conducted by the Centers for Disease Control & Prevention, the American Diabetes Association, and the National Business Group on Health, among others, highlight the importance of self-education for managing these chronic illnesses.

Creative Use of HCM Systems Is Key to Managing Employer Healthcare Costs

Whether an employer’s planned changes to their health plans in response to rising costs is as benign as simply moving from passive annual enrollment to active, offering optional new plans, or making minor prescription formulary changes to much more intrusive changes like escalating copays, deductibles and coinsurances or even transitioning the entire population to HDHPs, the Human Capital Management[1] infrastructure[3] should play a prominent role in the rollout of these changes. Simply stated, the more divorced a healthcare management and benefits communications strategy is from the organization’s HCM capabilities, the less effective it is likely to be. The days of paper mailings and even automated e-mails as a main communications strategy are – or should be – behind us.

Open Enrollment Tools Are Important, But….

By now, most employers recognize two foundational facts about new hires, life event change, and annual open enrollment processes:

- online enrollment must be offered “any time anywhere” the employee has an internet connection (not solely within the four walls of the work location), in large part due to a recognition that the employee is not always their family decision-maker about insurance decisions, and

- when employees (or their family members) get into the enrollment process[9], they often have questions that will interrupt the process and prevent its completion unless those questions are resolved.

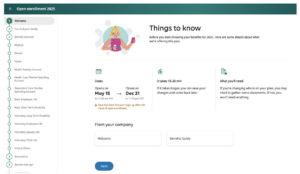

To address this issue of employee questions during the enrollment process, many employers incorporate various tools into that process – from glossaries to bullet point plan features to network provider directory links – and these tools can be quite effective (See Fig. 3), as far as they go.

Figure 3.

However, employers need to recognize that, from an employee education perspective, these steps are largely tactical rather than strategic.

The HCM “Secret Weapon” for Lowering Employer Healthcare Costs

Having determined that, when it comes to health plans, employees won’t choose what they don’t understand, employers facing major changes to their health plans this year need a secret weapon. To find it, they should look no further than the LMS. No matter what maturity stage that LMS strategy is in – fully implemented but lacking open enrollment-specific content, limited in deployment to subjects like job skills, safety, and compliance, or planned but not yet implemented – leveraging an LMS can “supercharge” an employer’s health benefits and wellness strategy.

Reviewing the list from earlier in this article of the ten potential actions employers will be taking in response to sharply rising health insurance costs, we see that all benefit from using an LMS to supplement basic employee communications. Obviously, the goal is to “cushion the blow” associated with these changes by educating the workforce, putting higher costs into perspective, offering alternative ways to save, etc.

In particular, where employers are introducing new plan types such as HDHPs and HSAs, and/or new wellness screenings for the first time, the LMS can make the difference between employees failing to understand the programs, jumping to uninformed conclusions, and assuming the new program is not beneficial to them, vs. fully understanding the nuances of the programs, making an informed decision about whether to elect/participate and ultimately viewing the new program as a “real” benefit to employees and not simply cost-cutting. Experienced benefits professionals know that traditional paper or e-mail-based communications “drops” are ignored by too many employees.

The usual question around this approach is, “How do we drive employees to this content if we’re concerned that they don’t read what we’re already sending them?” Part of the answer lies in the innate differences between wordy fliers (paper or PDF) and more active video content delivered within an LMS. Employers must remember the usual learner “rules of engagement” – particularly for Millennials and Gen Z – to keep the content brief, “punchy,” and relatable. Employ gamification[5] where possible. Break longer training units into 5–10-minute lessons. Entertain the learners. (See Fig. 4)

Figure 4.

However, there are more concrete steps that employers can and should take to drive the uptake of this content. One of the best strategies is to run contests with entries determined by the number of training units taken – the more valuable the prize, the better the attendance driver will be. Prizes comprised entirely of corporate logo merch will likely not drive attendance. Prizes like extra PTO days, tickets to popular sports or entertainment events, airfare for two nationwide, or even six months or a year of reimbursements for employee health insurance premiums[iv] will drive much greater content uptake. Employers may even want to add quizzes to the content at strategic places and require a minimum percentage of correct answers to generate an entry into the contest.

The ROI[13] of LMS-Driven Open Enrollment

The first step in calculating the ROI of an LMS-drive open enrollment process is to know the difference between the total employer cost of their highest-cost health plan (typically an open PPO or an HMO) and their lowest-cost plan (typically an HDHP with an HSA savings option.) For reference, Kaiser Family Foundation’s (kff.org) 2023 survey of these values found that the average PPO (family coverage) costs employers $23,968 annually, and the average HDHP/SO costs employers $22,344 annually.[v] That’s a savings to the organization of $1,624 per year for every employee who switches from traditional PPO coverage to HDHP/SO in an open enrollment.

Further, in a survey of employers, the Employee Benefits Research Institute (EBRI) found that first-year introductions of HDHP/SOs can experience enrollment rates as low as 20 percent – compared with the 29 percent average enrollment rate for more established plans that KFF has documented.

For a 1,000 benefits-eligible employee organization, an incremental enrollment rate of just 4 percent, where it can be credited to the use of an LMS, yields a savings of ~ $65,000 per year – liNDkely more than enough to justify the cost of the LMS and any fees for the benefits content. Bear in mind that the ROI associated with health insurance savings may pay for a new LMS (or an upgrade[10] to an existing one), but the system is then available for hundreds or thousands of courses and topics unrelated to healthcare plans – from leadership skills to safety, compliance, management training, personal growth…. the topics are virtually limitless.

Conclusion: LMS As the Ultimate Untapped Resource

Even as employers face tougher and tougher decisions about employee health insurance cost containment, there’s been relatively little researched or written about the “symbiotic” relationship between learning management systems and benefits technology. There is a growing trend for employers to look to include third-party AI-like coverage election simulators, “plug-in” enrollment tools, and plan/option configurators in their enrollment processes, but they should also look at their own LMS content as an alternative or supplemental, low-cost resource for achieving the same goal of educating employees to make better, more economical benefits choices. The ROI of this approach is clear and can even justify the acquisition of a new or upgraded LMS for organizations that don’t already have one in place.

ENDNOTES

1 70% of US workers would be willing to switch jobs for better benefits according to an Economist Impact study. (April 18, 2024) Find it here: https://www.economistgroup.com/group-news/economist-impact/70-of-us-workers-would-be-willing-to-switch-jobs-for-better-benefits

2 See for example, kiplinger.com, “High-Deductible Health Plans: Don’t Let the Name Scare You Off!”. Find it here:

https://www.kiplinger.com/personal-finance/insurance/health-insurance/602814/high-deductible-health-plans-dont-let-the-name

3 Greenwald Research, 2023 Annual Survey. Find it here: https://greenwaldresearch.com/health-plan-enrollees-spend-little-time-selecting-a-plan-and-are-largely-satisfied-with-enrollment/

4 Yes, it is legal, to reimburse one employee an amount equivalent to their health insurance premiums, provided that the additional compensation represented by these paid premiums are appropriately reported and taxed.

5 Kaiser Family Foundation, 2023 Employer Health Benefits Survey. Find it here: https://www.kff.org/report-section/ehbs-2023-section-1-cost-of-health-insurance/

Fig. 3. The introductory page of a typical HCM Open Enrollment process, offering various links and guides, and with reminders of key dates for completion.

Fig. 4. The contents of a Learning Management System[2] specific to benefit plans, open enrollment, and a new Health Savings Account option.

[i] 70% of US workers would be willing to switch jobs for better benefits according to an Economist Impact study. (April 18, 2024) Find it here: https://www.economistgroup.com/group-news/economist-impact/70-of-us-workers-would-be-willing-to-switch-jobs-for-better-benefits

[ii] See for example, kiplinger.com, “High-Deductible Health Plans: Don’t Let the Name Scare You Off!”. Find it here:

https://www.kiplinger.com/personal-finance/insurance/health-insurance/602814/high-deductible-health-plans-dont-let-the-name

[iii] Greenwald Research, 2023 Annual Survey. Find it here: https://greenwaldresearch.com/health-plan-enrollees-spend-little-time-selecting-a-plan-and-are-largely-satisfied-with-enrollment/

[iv] Yes, it is legal, to reimburse one employee an amount equivalent to their health insurance premiums, provided that the additional compensation represented by these paid premiums are appropriately reported and taxed.

[v] Kaiser Family Foundation, 2023 Employer Health Benefits Survey. Find it here: https://www.kff.org/report-section/ehbs-2023-section-1-cost-of-health-insurance/

Human capital management (HCM) is the comprehensive set of practices for recruiting, managing, developing and optimizing the human resources of an organization.

A software application that allows the creation delivery and management of learning and training resources and content.

The generic term to include all application software, operating systems, network communications and database management systems with an organization.

The process of granting or denying access to a system based on the permissions given to the user.

In an employment or HR context, gamification refers to a process of making systems, processes or other employment related activities more enjoyable and motivating through game design elements.