ESG is the elephant in today’s boardrooms. And, as we know, what’s in the boardroom affects the entire organization.

Post-pandemic business priorities have created pressure to address ESG issues, not just from consumers and investors but also employees and applicants. Buyers want to purchase from companies they see as ethical, and job candidates seek positions in firms that echo their values. Employees and prospective employees want assurance of fair and equitable corporate behavior with sustainability and environmental transparency. Regulators upped the ante for organizations with a plethora of reporting requirements, few of which are trivial. Addressing these concerns is a priority in reputation management, recruiting and retaining top talent, and compliance.

The global corporate world is aware of the increased linkage between financial reporting and sustainability reporting. While facing a barrage of new acronyms (SASB, ESRS, VRF, GHG, SDS, and many more),1 companies also face the challenge of meeting accounting and sustainability standards that, for the most part, many are ill-prepared to do.

The task is not trivial: as only one example, in 2022, the Securities and Exchange Commission proposed rule changes that would include climate-related disclosures, affecting not just companies planning IPOs but also all public companies as part of their regular reporting. The SEC would require reporting of such areas as:

- Governance of climate-related risks and relevant risk management processes;

- How climate-related risks identified that have had or are likely to have a material impact on its business and consolidated financial statements, short-, medium-, or long-term;

- How any identified climate-related risks have affected or are likely to affect the registrant’s strategy, business model, and outlook; and

- The impact of climate-related events (severe weather events and other natural conditions) and transition activities on the line items of consolidated financial statements and the financial estimates and assumptions used in the financial statements. 1

In The HR Professional’s Top Ten To-Do’s to Start 2023 Right, 2 I discussed the importance of preparing for changes in the SEC’s rule requiring reporting on human capital management. My “to do” was to acquaint myself with the Sustainability Accounting Standards Board (SASB) Standards. These standards identify the subset of environmental, social, and governance issues most relevant to financial performance and enterprise value, and they are just one example of the many new reporting requirements driving ESG accountability (including stricter requirements addressing climate change and greenhouse gases). While only one of the five dimensions of the SASB Standards, the Human Capital sustainability dimension encompasses employee health and safety management, employee engagement, diversity and inclusion, and labor practices.

According to the Securities and Exchange Commission, the goal of all this and similar legislation is, in part, to provide investors, stakeholders, consumers, and employees with consistent, comparable, and decision-useful information and provide consistent and clear reporting obligations for issuers.

What does it mean for businesses?

Measuring emissions such as greenhouse gases, much less reporting on them, is just the tip of the proverbial iceberg. Companies would next have to report on indirect emissions from purchased electricity or other forms of energy. The next proposed step is reporting suppliers’ data across the supply and value chain. While those suppliers likely also have to report their emissions, dicing that load over all their clients—basically per product—will prove challenging. Compounding this is a requirement to report on the emissions load companies are also delivering to their customers.

Addressing the “E” includes more than the reporting standards; actual plans to mitigate or remedy areas of environmental and health impacts (remember Love Canal?), water, waste, toxic materials management, and much more will be required. Like massive ERP transformations, tackling ESG involves far more than appointing someone the “ESG Tzar.”

Addressing the “E” includes more than the reporting standards; actual plans to mitigate or remedy areas of environmental and health impacts (remember Love Canal?), water, waste, toxic materials management, and much more will be required. Like massive ERP transformations, tackling ESG involves far more than appointing someone the “ESG Tzar.”

However, the social and governance areas deal with far more than climate change and remediation plans. The impact of non-reusable or non-degradable materials, careless risk management, or reliance on sweatshop labor by suppliers are further examples. And here is a relevant “for instance”: given the plethora of AI products in the market that need data fed into their learning machines, a new definition of sweatshop labor emerges: poorly paid offshore workers are now poorly paid data slaves, feeding information into those AI engines.

Companies today are often ill-equipped to identify their own emissions, much less those stemming from their supply chains. Few adequately understand their suppliers’ human capital and working environments, especially those offshore. Many have yet to satisfactorily address diversity, equity, and inclusion goals – all part of the “governance” area.

Organizations are not blind to the issues: McKinsey reports that 29 percent of executive respondents say their companies will build a sustainability-focused business in the next five years, expecting those businesses to offer sustainable intangible services, such as supply chain tracing or green financing, or sustainable products or materials, such as solar cells or batteries.3

Companies are usually eager to publicize their sustainability plans: IKEA, for example, pledges to reduce emissions from its maritime shipping operations by 70% from their 2017 levels before 2030.4 The positive responses such announcements create are noted by employees, stockholders, and potential job candidates. However, a transparent follow-up plan and delivery accountability are required to maintain that positive perception.

What does this mean for HR Professionals?

At first glance, HR executives may think that their organizations’ ESG responsibilities are unrelated to them. Instead, they will be the responsibility of those in production, supply chain management, or just the executive suite. Not so.

Gallup conducted a round table of CHROs in 2022, reporting that solely 4% of the CHROs play no part in ESG reporting, 34% are accountable only for the social component of ESG, 53% partner with a sustainability/CSR committee, and 9% have sole responsibility for ESG reporting.5

While I hope that none of you are among the 9% with sole responsibility for ESG reporting, you are more likely to be teamed with others across your organization to aid in reporting. And note that reporting is only step one: more important is the plan to address issues such as sustainability in your organization. This is not a “one-and-done” task.

Brian Sommer, author of “The Executive’s ESG Playbook,” 6 offers a thorough and very readable introduction to ESG, focusing on the key roles in the executive office, including CHROs. He also provides a five-year planning agenda that can assist in moving from reporting to action.

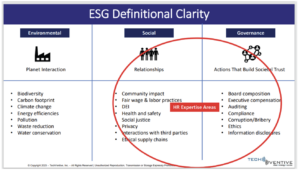

Sommer offers this diagram to summarize where HR will likely have primary roles (See Figure 1).

Figure 1. Where HR Can Lead in ESG Initiatives?

Source: Brian Sommer, TechVentive, 2023.

While HR may have led in creating paperless offices, providing recycling bins throughout the organization, fostering volunteer programs, and promoting LEED buildings, the future will require more encompassing areas, such as minimizing the carbon footprints of commuters and corporate travelers. Some companies use the “offset” model: the company vows to plant a tree for every five hundred miles an employee travels or donates to save the rainforests.

Some of these are valid; some are solely lip service and do nothing (such as vowing to save an acreage of rainforest that was not under threat.)

Much of today’s HR software may not help. While applications usually provide analytics about diversity and perhaps even payroll equity, the disparate nature of many HR environments and the plethora of unintegrated applications will challenge even initial reporting.

Where are Software Providers Today?

Software vendors are working to catch up: purely as examples, articles on sites such as Oracle, SAP, and Workday guide issues surrounding procurement, supply chain management, internal compliance, and the like. The companies state their sustainability footprint management and intent for a zero-carbon future, commitment to responsible design and production, commitment to protect natural resources, use of ethical and sustainable supply chains, and the tools they have to aid customers in this endeavor.

Oracle, again as an example, recently launched five new ESG configuration guides for its Oracle Fusion Cloud applications, as reported by their Chief Sustainability Officer Jon Chorley.7 The updated configuration guides offer instructions for capturing environmental data as part of everyday operations, integrating sustainability into the core of business processes. Applications of this type will prove valuable in ESG endeavors.

Today’s software primarily focuses on reporting more than measuring and remediating problematic issues, an essential first step. However, major vendors will increasingly offer more, such as goal setting and longer-term planning guidance.

Don’t Give Up.

The task may look gargantuan–and in fact, it is. HR cannot address the whole elephant at once, even for its portion of the total corporate undertaking. Break the areas that HR is responsible for into addressable chunks: First by ascertaining scope, then developing a multi-year plan to collect the data needed to understand the current state, and, beyond reporting, support the creation of an environment that is ethical, socially responsible, carbon neutral, and sustainable for the future.

ENDNOTES

1 Sustainability Accounting Standards Board, European Sustainability Reporting Standards, Value Reporting Foundation—now part of IFRS (International Financial Reporting Standards), Greenhouse Gas, IFRS Sustainability Disclosure Standards. There are many, many more. SEC.gov | SEC Proposes Rules to Enhance and Standardize Climate-Related Disclosures for Investors, https://bit.ly/3SFWqNt.

2 The HR Professional’s Top Ten To-Do’s to Start 2023 Right. Katherine Jones, Workforce Solutions Review, 4th Quarter, 2022, https://bit.ly/3FVDLFV.

3 New-business building in 2022: Driving growth in volatile times. McKinsey & Company. November 14, 2022, https://bit.ly/3QTDRE5.

4 Partnership to reduce carbon emissions on rail route – IKEA Global, https://bit.ly/4775uQ0.

5 Why Leaders Should Partner with CHROs in ESG Reporting. By Jeremie Brecheisen And Jennifer Robison. Gallup Workplace. August 26, 2022, https://bit.ly/3SAs4vK.

6 The Executive’s ESG Playbook by Brian Sommer. TechVentive, Inc. 2023. (Available on Amazon for $29.99.)

7 Interview for this article, 9/29/2023.